In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of January 16

A Look Into the Markets

After a multi-month decline in interest rates, we are seeing positive momentum in housing emerge. Let’s look at some of the numbers from this week and highlight events to watch for in the weeks ahead.

Spring in January?

Not quite, but we have seen an uptick in inventory and mortgage applications over the last couple of weeks. This should be no surprise as interest rates moved sharply lower between the months of November and December. Much like we saw last year, with any dip in rates, housing activity picks up.

If rates remain near current levels or slightly improved, and the labor market remains tight, we should see far more purchase activity in 2024. As Lawrence Young, Chief Economist of the National Association of Realtors stated, “life goes on”. There is a lot of pent-up demand and housing could have a surprise year in activity.

4.00%

The 10-year Note has been hovering around the 4% mark for the past few weeks; a further sign of some stability in the bond market. There is still much debate and uncertainty surrounding how many Fed Rate hikes we will see this year. Currently, they are forecasting three rate hikes in 2024. The Fed Funds Futures which price in the probability of rate cuts, are suggesting the Fed will cut rates six or even seven times. Someone is going to be right, and someone is going to be wrong. If the Fed cuts rates more aggressively, interest rates will decline. And the opposite is true.

Jobs Report, Not so Rosy

The recent Jobs Report reading for December showed 216,000 jobs were created in the economy. The media and others were celebrating the strong headline number. However, interest rates, which hate good news, didn’t rise in the days since the release. Why? A closer look under the hood of the report, showed that the economy lost 1.5M jobs in December as shown in the Household survey within the release. And we hit a record high of 8.5 million people working multiple jobs. So overall, the jobs report was not so good when you look at some of the internals. If future labor market readings show similar weakness, it would prompt the Fed to cut rates sooner than the middle of the year, which is their current forecast. Once again, the opposite is true.

Consumer Inflation Mixed

The December Consumer Price Index was reported on Thursday and overall, it was in line to slightly higher. Shelter remains the largest contributor to overall inflation, making up nearly two-thirds of the Core CPI (which removes food and energy prices).

Bottom line: The trend in inflation remains lower; the economy is slowing, and the labor market is loosening. All of this should help lower rates while also avoiding a deep recession or a recession at all. This is potentially wonderful news for housing.

Looking Ahead

Next week there is lower impact economic news, but we will get many readings on the housing market. Last year every dip in rates was met with housing activity. We shall see if these readings support NAR’s Lawrence Yun’s take that housing activity has indeed picked up.

Mortgage Market Guide Candlestick Chart

Mortgage bond prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 5.5% coupon, where currently closed loans are being packaged. As prices move higher, rates decline, and vice versa.

On the far-right side of the chart, you can see how prices have gone sideways to slightly lower, highlighting home loan rates moving sideways to slightly higher.

Chart: Fannie Mae 30-Year 5.5% Coupon (Friday, January 12, 2024)

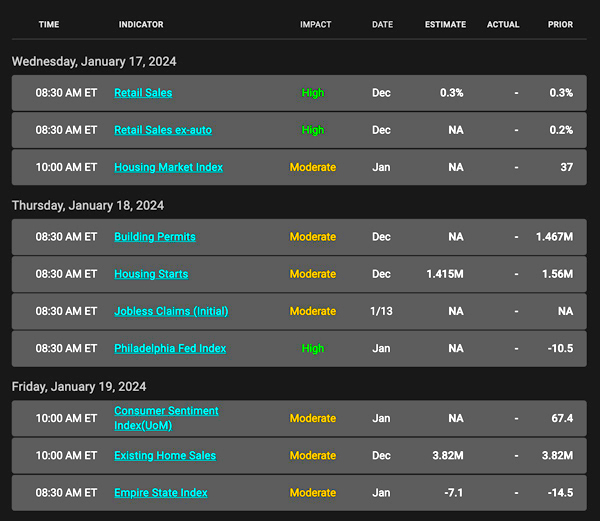

Economic Calendar for the Week of January 15 – 19

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the WEEKLY Newsletter because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.