In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of March 15

A Look Into the Markets

This past week interest rates ticked up, amidst higher inflation numbers and U.S. debt being sold. Let’s look at what happened as we approach the important Fed Meeting next week.

Consumer Prices Remain Elevated

The Consumer Price Index (CPI) for February came in above expectations with shelter and energy making up a large portion of the reading. The higher numbers have pushed the chance of a Fed rate cut to June.

Long-term rates, like mortgages, which are driven by economic expectations and inflation, also didn’t like the reading and moved off of the best levels of the week.

Fed Chair Powell has been very clear that they will not cut rates until they see inflation move “sustainably” towards 2%. The last few months of CPI have shown month-over-month readings of .03% to .04%. Annualized, this is much hotter than the 2% inflation target of the Fed.

Producer Prices Higher Too

The Producer Price Index, a leading indicator to consumer inflation, also came in hotter than expected. There is a concern here. If it costs more to produce/create goods and services, they are forced to pass those additional costs to consumers.

Weak Retail Sales

Retail Sales is an important measure on the health of the economy. Consumer spending makes up two-thirds of economic growth or GDP. If consumers slow down spending, economic growth slows. Retail Sales for February came in below expectations, highlighting the consumer is being cautious and feeling the pinch of inflation. Another sign of inflation’s impact on the consumer is, when you adjust retail sales for inflation, retail sales have been essentially flat for almost two years. This means that consumers are not buying goods and services – they are just paying more.

Deficit Spending Continues

The Treasury Department sold billions of dollars of bonds this past week to help fund our government. These auctions bring a weight to the market, which pushes prices downward and elevates rates. We watched this play out again this past week as rates pulled back from the best levels in a month.

Bank of Japan Ending Negative Rates

There is growing speculation that the Bank of Japan will be the last country to keep negative rates. This has started to push their yields to the highest levels of the year. As their rates edge higher, it puts pressure on our rates here in the U.S.

Bottom line: Rates are moving sideways to higher on inflation fears and the notion the Fed will be cutting rates later than anticipated. The 10-yr Note has a closing high of 4.32% this year. Watch that level carefully as we enter Fed week.

Looking Ahead

Next week is all about the Federal Reserve. They are slated to meet on Wednesday and there is no chance of a rate cut. What will be market moving is what the Fed says about cuts in the future. There is growing speculation the Fed may not even cut in June. It’s this uncertainty that is making volatility in the bond market and interest rates.

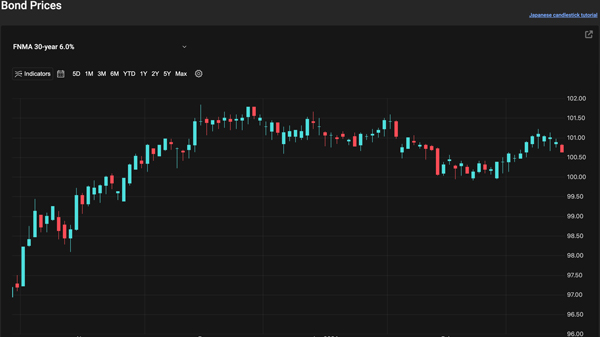

Mortgage Market Guide Candlestick Chart

Mortgage bond prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 6.0% coupon, where currently closed loans are being packaged. As prices move higher, rates decline, and vice versa.

If you look at the right side of the chart, you can see how prices have backed away and moved lower from the $101 level. There is a lot of support at the $100 level and that floor will be important to hold as we go through Fed week.

Chart: Fannie Mae 30-Year 6.0% Coupon (Friday, March 15, 2024)

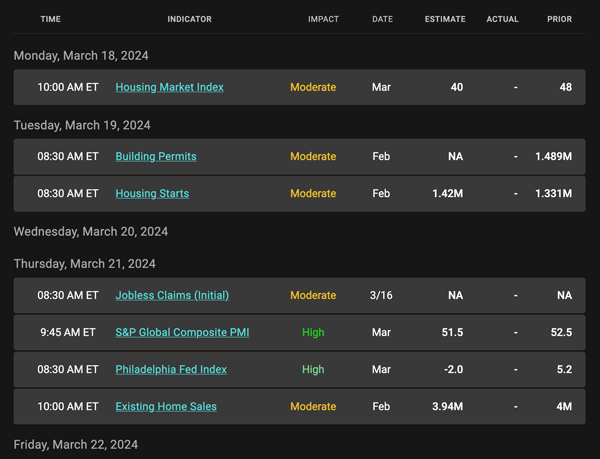

Economic Calendar for the Week of March 18 – 22

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the WEEKLY Newsletter because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.